In recent years, GLP-1 medications like Ozempic have progressed from a specialised diabetes treatment into a more widespread weight loss tool used by a wide range of people globally.

In this article, we’ll examine key statistics surrounding Ozempic and other GLP-1 medications, including how many people are using these drugs, the growth of this market, and the broader implications on health and healthcare accessibility.

Key statistics

- Around 12% of adults in the U.S. say they have ever used a GLP-1 medication.

- Semaglutide (Ozempic and Wegovy) resulted in a 14.9% reduction in body weight in clinical trials, while tirzepatide (Mounjaro and Zepbound) led to a 20.9% body weight reduction.

- In the UK, women make up 77.6% of Mounjaro users, while men account for 22.4% of users.

- Roughly 10 times more people buy Mounjaro privately in the UK than receive it through the NHS.

- The average age of GLP-1 medication users in the UK is 44 years, with people aged 40-59 making up more than half of users (53.5%).

- 43% of people diagnosed with diabetes in the U.S. report using a GLP-1 medication at some point, along with 22% of people diagnosed as overweight or obese.

- The monthly cost of Ozempic in the U.S. can reach as high as $1,200 out-of-pocket for people without insurance.

What are GLP-1 medications?

GLP-1 (glucagon-like peptide-1) is a naturally occurring hormone produced in the intestines after eating. This hormone helps to regulate blood sugar levels and gives you a feeling of fullness after you eat.

GLP-1 medications, often referred to as GLP-1 agonists, are a type of medications that help manage blood sugar levels in people with Type 2 diabetes, and they are also used to treat obesity. These medications work by triggering insulin release from the pancreas, blocking glucagon secretion, slowing stomach emptying, and making you feel fuller after you eat.

Ozempic is one of the most well-known brands of GLP-1 drugs, but it’s not the only one. There are a number of these medications currently available, some of which include:

- Semaglutide injection (Ozempic®)

- Semaglutide injection (Wegovy®)

- Semaglutide tablets (Rybelsus®)

- Dulaglutide (Trulicity®)

- Exenatide (Byetta®)

- Exenatide extended-release (Bydureon®)

- Liraglutide (Victoza®)

- Lixisenatide (Adlyxin®)

- Tirzepatide injection (Mounjaro®)

Source [1]

Global GLP-1 receptor agonist market

In 2024, the global GLP-1 receptor agonist market size was valued at an estimated USD 53.46 billion and is projected to reach USD 156.71 billion by 2030, with a Compound Annual Growth Rate (CAGR) of 17.46% between 2025 and 2030. [2]

Novo Nordisk and Eli Lilly

Globally, the GLP-1 medications market is controlled by two major pharmaceutical companies, U.S.-based Eli Lilly and Denmark-based Novo Nordisk. As of May 2024, Novo Nordisk had a market value of $570 billion, making it bigger than the entire economy of Denmark.

These companies create distinct products with different brand names, which all fall under the same category of GLP-1 medications. This is typically because they create variations of the same drug to suit different patient needs and delivery methods. [3]

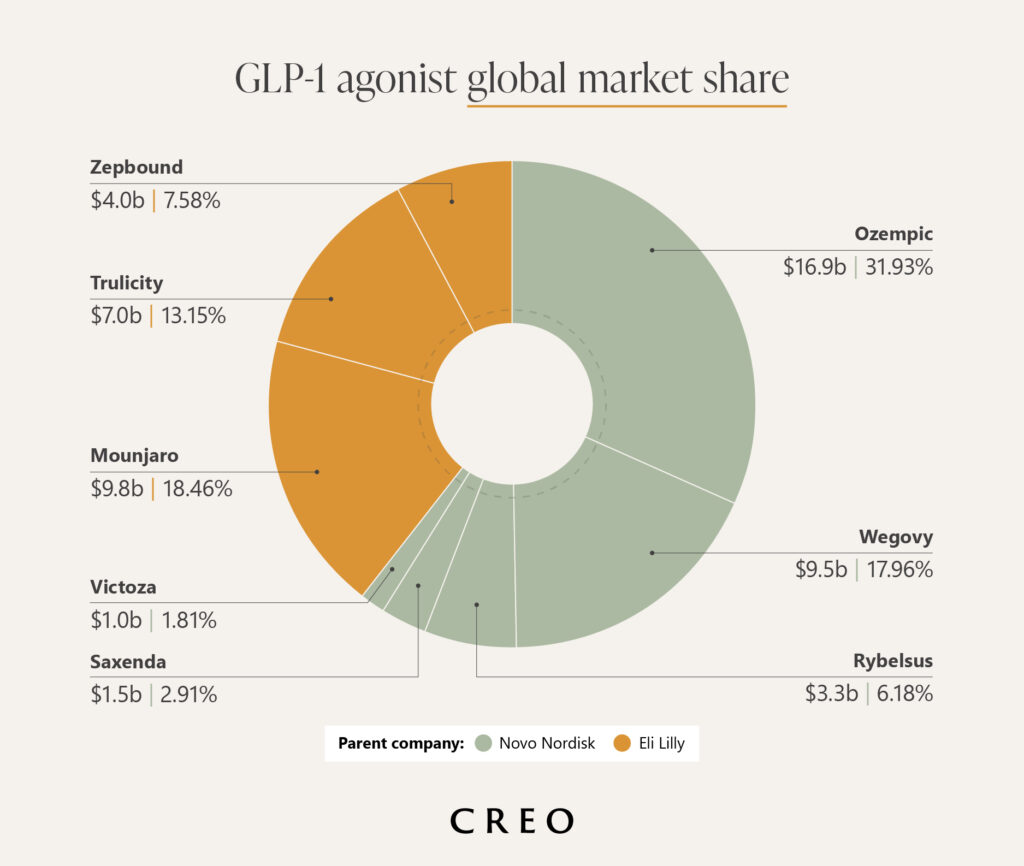

The table below shows the different GLP-1 medication products owned by Eli Lilly and Novo Nordisk, and their global market sizes. Based on market size data of these medications from different sources, we estimate that Ozempic has the largest market share globally with 31.93% and $16.9 billion USD, followed by Mounjaro with 18.46% and $9.8 billion USD.

| GLP-1 product name | Parent company | Market share USD (billions) | % market share |

| Ozempic | Novo Nordisk | $16.9 | 31.93% |

| Mounjaro | Eli Lilly | $9.8 | 18.46% |

| Wegovy | Novo Nordisk | $9.5 | 17.96% |

| Trulicity | Eli Lilly | $7.0 | 13.15% |

| Zepbound | Eli Lilly | $4.0 | 7.58% |

| Rybelsus | Novo Nordisk | $3.3 | 6.18% |

| Saxenda | Novo Nordisk | $1.5 | 2.91% |

| Victoza | Novo Nordisk | $1.0 | 1.81% |

View methodology for full source list.

GLP-1 agonist market in the U.S.

The U.S. GLP-1 receptor agonist market generated revenue of $39.64 billion USD in 2024, with a projected $120.91 billion USD by 2030 and a CAGR of 18.1% between 2025 and 2030.

The U.S. accounted for 74.2% of the global GLP-1 receptor agonist market in 2024, and is projected to lead the North America market and the global market in terms of revenue in 2030. When breaking down product segments, Ozempic generated the most revenue in 2024. [4]

Due to the high demand for GLP-1 drugs in the U.S. following the rise in popularity of Ozempic, the U.S. experienced a shortage of these medications. Following this, the Food and Drug Administration (FDA) gave other pharmaceutical companies permission to make non-branded, compounded versions of the drugs, using the active ingredient, semaglutide. However, Novo Nordisk argued that these versions are not FDA-approved and therefore pose safety risks to users, and subsequently filed over 100 lawsuits against the companies selling them.

Once the FDA determined that the official, branded versions of the drugs were no longer in shortage, a federal judge ruled that the compounding pharmacies could not continue making the non-branded versions. [5]

GLP-1 agonist market in the UK and Europe

In the UK, the GLP-1 receptor agonist market reached a revenue of $847 million USD in 2024, with an expected revenue of $2.2 billion by 2030 and a CAGR of 16% between 2025 and 2030. Globally, the UK accounted for 1.6% of the GLP-1 receptor agonist market. In Europe, Germany is projected to lead the regional market by 2030, and Sweden is the fastest-growing market, with a projected revenue of $855.6 million USD by 2030. [6]

Diabetes statistics

Diabetes is a chronic disease, characterised by a person’s body not being able to produce or utilize insulin adequately enough to absorb glucose from the bloodstream. In people with type 1 diabetes, the pancreas does not produce enough insulin, but with Type 2 diabetes, the pancreas produces enough insulin, but the body is not able to process it properly. GLP-1 drugs have been used for treating diabetes for around 20 years. [7]

Data from 2024 shows that, in the UK, there are an estimated 5.8 million people living with diabetes, an all-time high. Around 90% of these people have type 2 diabetes, 8% have type 1 diabetes, and 2% have other forms of diabetes. [8]

In the U.S., the latest available data from 2021 shows that 38.4 million people of all ages (or 11.5% of the population) had diabetes. [9]

Obesity statistics

Data from the World Health Organization (WHO) as of 2022 shows that globally, around 2.5 billion adults and 390 million children are classed as overweight. Of these, 890 million adults and 160 million children are living with obesity. [10]

In the U.S., more than 30% of adults, and 16% of children aged between two and 19 are overweight.

A 2022 study by the UK Parliament found that, in England, 28% of adults were obese and a further 36% were overweight. It also found that more than two-thirds of people aged 35 and over were overweight or obese. [11]

How much weight can people lose with GLP-1 drugs?

Research into the efficacy of GLP-1 drugs found that, in a clinical trial setting, Semaglutide (Ozempic and Wegovy) could result in a 14.9% reduction in body weight over the course of 68 weeks. Another clinical trial found that over 72 weeks, tirzepatide (Mounjaro and Zepbound) could lead to a 20.9% reduction in body weight.

For real-world users, studies show that, after one year, participants taking Semaglutide lost 7.7% of their body weight, and participants taking tirzepatide lost 12.4% of their body weight.

This data shows that users in clinical trials lost more weight than real-world users when taking GLP-1 medications. However, researchers suggested that this difference could be explained by 50% of the patients discontinuing their treatment during the first year, and 80% taking lower dosages. Clinical trials are also conducted in ideal medical settings, which can’t always be replicated outside of these conditions.

Though several factors could be contributing to the lower rates of weight loss in real-world examples, GLP-1 drugs still result in significant reductions in body weight. Experts suggest that even a 5% weight reduction can help with many health conditions, including diabetes. [12]

Common side effects of GLP-1 medications

Like with most medications, GLP-1 agonists can cause side effects in certain patients.

Most common side effects:

- Nausea

- Vomiting

- Diarrhea

- Constipation

Less common side effects

- Pancreatitis – Inflammation of the pancreas, causing abdominal pain

- Gastroperesis – The stopping or slowing of food moving out of the stomach

- Bowel obstruction – A blockage that prevents food from passing through the intestines

- Gallstones – Gallstone attacks and bile duct blockage

- “Ozempic Face” – A hollowed look on the face, wrinkles on the face, and a change in the appearance of facial features as a result of rapid weight loss

Source [7]

GLP-1 medication statistics in the UK

Statistics on GLP-1 medication usage in the UK are more limited than in the U.S. However, one study into the use of one of these medications, Mounjaro, found that approximately 500,000 people in the UK have used the drug privately for weight loss since 2023.

Mounjaro holds 79% of the GLP-1 medication market in the UK, compared to competitor Wegovy with 20%.

The data also shows that around 10 times more people buy Mounjaro privately than receive it through the NHS in the UK. This is likely due to NHS eligibility rules being much stricter, leading to more people opting for private providers.

For treatment through the NHS, patients are typically required to have:

- A Body Mass Index (BMI) of 40 or above

- At least four of the following weight-related conditions

- High blood pressure (hypertension)

- Heart disease (cardiovascular disease)

- Abnormal blood fats (dyslipidemia)

- Obstructive sleep apnea

- Type 2 diabetes

- Must have tried other weight loss methods first

Women make up the majority of Mounjaro users in the UK at more than three-quarters (77.6%), while men account for 22.4% of users. [13]

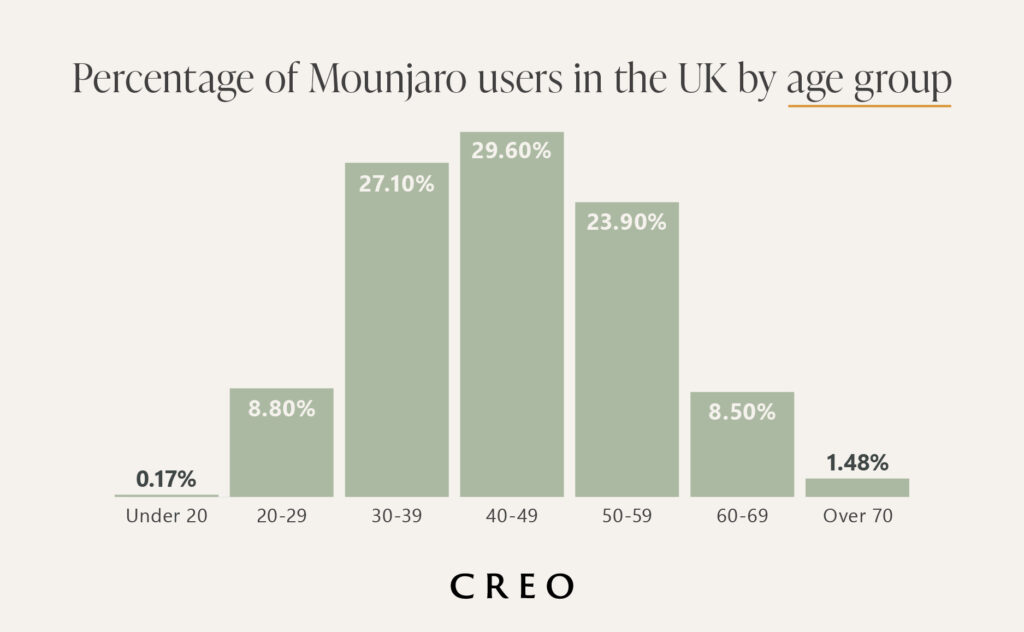

GLP-1 medication use by age in the UK

The median age of Mounjaro users in the UK is 44 years old, with those aged between 40 and 59 making up more than half of all users (53.5%). People under 20 are the least likely to have used this drug for weight loss (0.17%) followed by people aged 70 or over (1.48%).

Source [13]

How much weight do UK Mounjaro users lose on average?

An analysis of data from Mounjaro users found that, on average, people lost 15.3 pounds during approximately six weeks of treatment. This equates to an average of 3.6 pounds per week for those individuals, a rate that is generally seen as fast but sustainable by medical standards.

The efficacy of drugs like Mounjaro can depend on a number of different factors, including diet and exercise habits, individual metabolisms, starting weight, and consistency with taking the medication. [13]

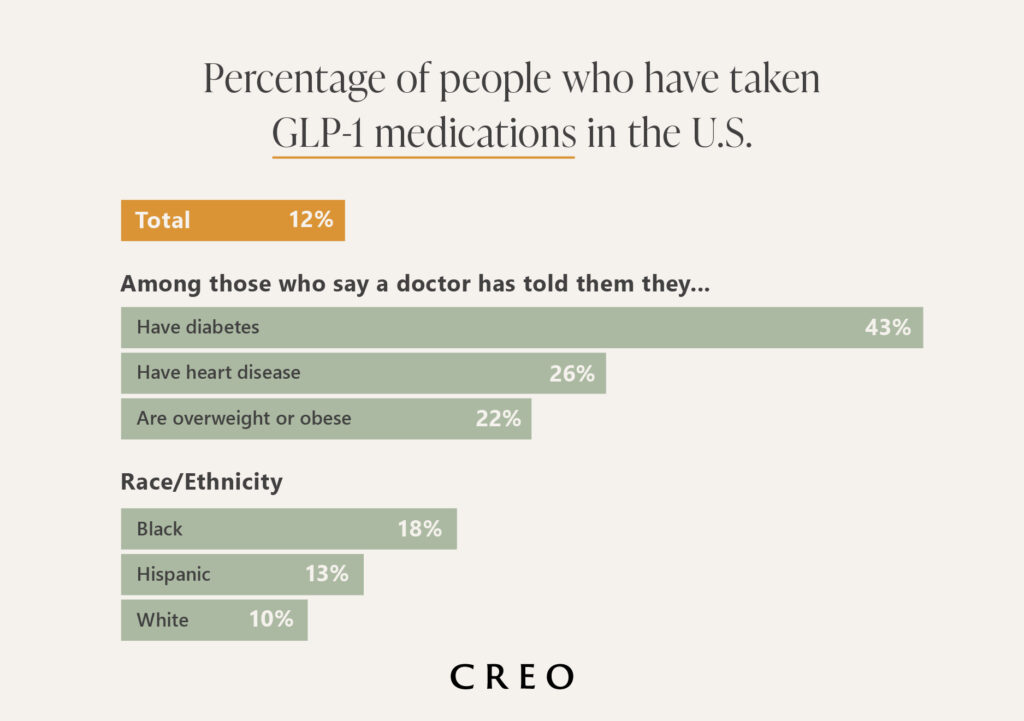

The use of GLP-1 medications in the U.S.

Data from the U.S. shows that approximately one in eight adults (12%) have used a GLP-1 agonist at some point, including 6% who said they are currently using one of these medications.

Among adults who have been diagnosed with diabetes, the usage rate of these drugs rises to 43%. Around a quarter (26%) of people diagnosed with heart disease have used GLP-1 medications, and 22% of people diagnosed as being overweight or obese say they have used them or are currently using them.

The data shows that 18% of Black adults have taken these medications, making them more likely to have used them than White adults (10%), and Hispanic adults (13%). An analysis of CDC data also found that Black and Hispanic adults in the U.S. are more likely to experience obesity than White adults.

Source [14]

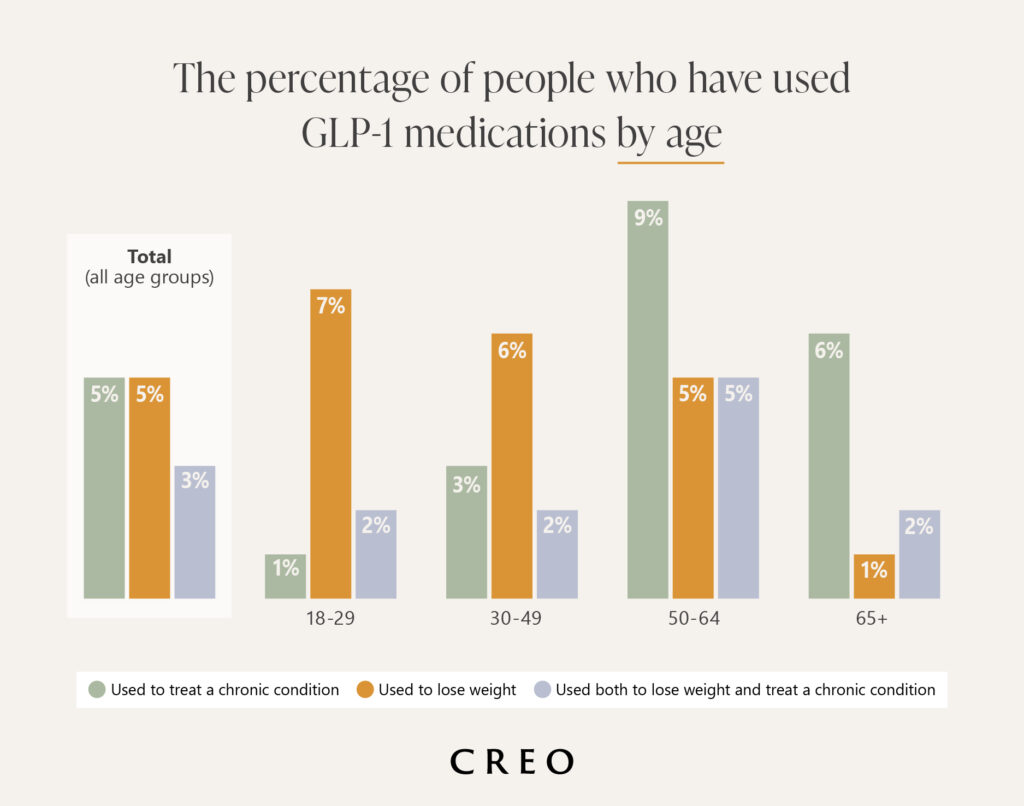

GLP-1 medication usage by age in the U.S.

The way people use GLP-1 medications varies depending on age; the data shows that older adults are more likely to use these drugs to treat chronic conditions like diabetes, while younger people use them more for weight loss. A survey of people in different age groups asked whether respondents had ever used GLP-1 medications and, if so, what they had used them for.

- For people aged 18-29, only 1% had ever used GLP-1 drugs to treat chronic conditions, while 7% of those in this age group had used them for weight loss, and a further 3% had used them for chronic conditions and weight loss.

- In the 30-49 age group, 3% had used GLP-1s to treat chronic conditions, 6% for weight loss, and 2% for both.

- The 50-64 age group is the most likely to have used these medications to treat chronic conditions (9%), while 5% of this group had used them for weight loss, and another 5% had used them for both chronic conditions and weight loss.

- In the over-65 group, 6% had used GLP-1s for chronic conditions, 1% for weight loss, and 2% had used them to treat both.

Source [14]

GLP-1 medications and excisional surgery

The rise in the use of GLP-1 medications for weight loss has led to more people seeking out excisional surgeries to remove loose skin following significant weight loss.

Some of the surgeries that we have seen increased demand for following GLP-1 usage include:

- Brachioplasty (arm lift)

- Thigh lift

- Buttock lift

- Abdominoplasty (tummy tuck)

- Back lift (lower and upper/bra line)

- Monsplasty

Data from our previous study of cosmetic surgery statistics shows how some of these procedures have grown in popularity in recent years. Thigh lifts saw the biggest increase of 23.6% between 2023 and 2024, while blepharoplasty procedures increased by 13.3% and brachioplasty increased by 12.9%.

| The change in the number of skin-tightening procedures in the UK (2023-2024) | |

| Procedure | % change |

| Blepharoplasty | 13.3% |

| Abdominoplasty | 5.9% |

| Brachioplasty | 12.9% |

| Thigh Lift | 23.6% |

| Lower Body Lift | 8.4% |

How much do GLP-1 medications cost?

The cost of GLP-1 weight loss drugs varies depending on the dosage, where you live, and which particular medication you are taking.

U.S. costs for GLP-1 drugs

In the U.S., GLP-1 drugs can often be covered by insurance and Medicare, depending on what you are using them for. The list price for these drugs can range between $1,000 and $1,350 per month, though the actual price people pay will depend on their insurance coverage, dosage, and where they buy from.

As of November 2025, an arrangement was made between the U.S. government and the two leading GLP-1 drugmakers, Eli Lilly and Novo Nordisk, to reduce the costs of these drugs.

Under this deal, consumers buying injectable GLP-1 medications directly from these companies will pay $350 on average to begin with. The drug manufacturers have agreed to reduce the price to approximately $250 over the next two years. For oral GLP-1 medications approved by the U.S. Food and Drug Administration (FDA), the lowest dose will cost $149 under the new scheme.[15]

UK costs for GLP-1 drugs

Estimated prices for GLP-1 injections containing tirzepatide sourced privately in the UK vary from £139 for a 2.5mg dose to £289 for a 15mg dose. Data shows that these prices can vary depending on dosage, availability, and service fees. Some providers might advertise lower prices, but these sometimes come with delivery delays or issues with low stock.

| Estimated costs of GLP-1 injections containing tirzepatide in the UK | |

| Dose | Updated UK List Price (From 1 Sept 2025) |

| 2.5mg | £139 |

| 5mg | £169 |

| 7.5mg | £219 |

| 10mg | £249 |

| 12.5mg | £269 |

| 15mg | £289 |

Source [16]

The future of GLP-1 medications

When looking ahead to the future of GLP-1 medications, the global market is expected to rise to $187 billion by 2032, with a CAGR of almost 17%. Research shows that there are over 80 medications currently in development, with at least 25 companies testing GLP-1s. [17]

In November 2025, Pfizer won a bidding war with Novo Nordisk, acquiring obesity drug developer, Metsera. This gives them a number of injectable and oral GLP-1 candidates, which are expected to begin clinical trials soon. [18]

Other research suggests that several pharmaceutical companies, including AstraZeneca, Zealand Pharma, Roche, and Amgen, are expected to enter the GLP-1 market, with multiple drug launches planned between 2027 and 2032. This means the current duopoly between Eli Lilly and Novo Nordisk could start to be diluted, potentially leading to more competition in the market. [19]

GLP-1 U.S. market size methodology

To calculate an estimated market share of GLP-1 agonist products in the U.S., we collected data on market sizes of these products from the following sources:

- https://www.grandviewresearch.com/horizon/statistics/semaglutide-market/product/ozempic-semaglutide/global

- https://www.grandviewresearch.com/horizon/statistics/glp-1-receptor-agonist-market/product/mounjaro-tirzepatide/global

- https://www.grandviewresearch.com/horizon/statistics/glp-1-receptor-agonist-market/product/wegovy-semaglutide/global

- https://www.grandviewresearch.com/horizon/statistics/glp-1-receptor-agonist-market/product/trulicity/global

- https://www.grandviewresearch.com/horizon/statistics/obesity-treatment-market-outlook/glp-1-receptor-agonists/tirzepatide-zepbound/global

- https://www.grandviewresearch.com/horizon/statistics/semaglutide-market/product/rybelsus-oral-semaglutide/global

- https://www.grandviewresearch.com/horizon/statistics/obesity-treatment-market-outlook/glp-1-receptor-agonists/liraglutide-saxenda/global

- https://www.grandviewresearch.com/horizon/statistics/glp-1-receptor-agonist-market/product/victoza-liraglutide/global

Sources

- Cleveland Clinic, “GLP-1 Agonists” https://my.clevelandclinic.org/health/treatments/13901-glp-1-agonists

- Grand View Research, “GLP-1 Receptor Agonist Market Size and Share” https://www.grandviewresearch.com/industry-analysis/glp-1-receptor-agonist-market

- JP Morgan, “The Increase in Appetite for Obesity Drugs https://www.jpmorgan.com/insights/global-research/current-events/obesity-drugs

- Grand View Research, “U.S. GLP-1 Receptor Agonist Market” https://www.grandviewresearch.com/horizon/outlook/glp-1-receptor-agonist-market/united-states

- Fierce Pharma, “U.S. Court Decision Prevents Compounders from Producing Knockoffs of Novo Nordisk’s Semaglutide” https://www.fiercepharma.com/pharma/us-court-decision-prevents-compounders-producing-knockoffs-novo-nordisks-semaglutide

- Grand View Research, “UK GLP-1 Receptor Agonist Market” https://www.grandviewresearch.com/horizon/outlook/glp-1-receptor-agonist-market/uk

- Harvard University, “GLP-1 Diabetes and Weight Loss Drug Side Effects: Ozempic Face and More” https://www.health.harvard.edu/staying-healthy/glp-1-diabetes-and-weight-loss-drug-side-effects-ozempic-face-and-more

- Diabetes.org, “How Many People in the UK Have Diabetes?” https://www.diabetes.org.uk/about-us/about-the-charity/our-strategy/statistics

- CDC, “National Diabetes Statistics Report” https://www.cdc.gov/diabetes/php/data-research/index.html

- WHO, “Obesity and Overweight” https://www.who.int/news-room/fact-sheets/detail/obesity-and-overweight

- Research Briefings, “Obesity Statistics” https://researchbriefings.files.parliament.uk/documents/SN03336/SN03336.pdf

- Health.com, “Think GLP-1s Guarantee Weight Loss? Real-World Data Says Otherwise” https://www.health.com/glp-1-drugs-real-world-weight-loss-11752679

- Click2Pharmacy, “Mounjaro Statistics 2025” https://click2pharmacy.co.uk/mounjaro-statistics-2025/

- KFF, “KFF Health Tracking Poll 2024: The Public’s Use of GLP-1 Drugs” https://www.kff.org/health-costs/kff-health-tracking-poll-may-2024-the-publics-use-and-views-of-glp-1-drugs/

- CNN, “Certain Obesity Drugs Will Cost as Little as $149 and Medicare Will Start Covering Them Under White House Deals” https://edition.cnn.com/2025/11/06/politics/weight-loss-drugs-medicare-deals

- Drugs4Delivery, “Mounjaro and Wegovy Price Changes Coming September 2025” https://drugs4delivery.com/mounjaro-and-wegovy-price-changes-coming-september-2025/

- Delve Insight, “9 Promising Obesity Drugs Set To Launch by 2030” https://www.delveinsight.com/blog/obesity-drugs-launch

- Pfizer, “Pfizer to Acquire Metsera and Its Next Generation Obesity Portfolio” https://www.pfizer.com/news/press-release/press-release-detail/pfizer-acquire-metsera-and-its-next-generation-obesity

- Morning Star, “Two Companies Poised to Capitalize on the Rise of GLP-1 Drugs” https://www.morningstar.com/sustainable-investing/2-companies-poised-capitalize-rise-glp-1-drugs